Financials

Independent Registered Municipal Advisor

2024 Annual Comprehensive Financial Report

Canaveral Port Authority

Canaveral Port Authority

2024 - 2025

Micah Loyd |

Wayne E. Justice |

Jerry W. Allender |

Kevin Markey |

Fritz VanVolkenburgh |

John W. Murray |

Jeff Long |

Patricia G. Poston |

Diana Mims-Reid |

Listing of Principal Officials As of September 30, 2024

Elected Officials

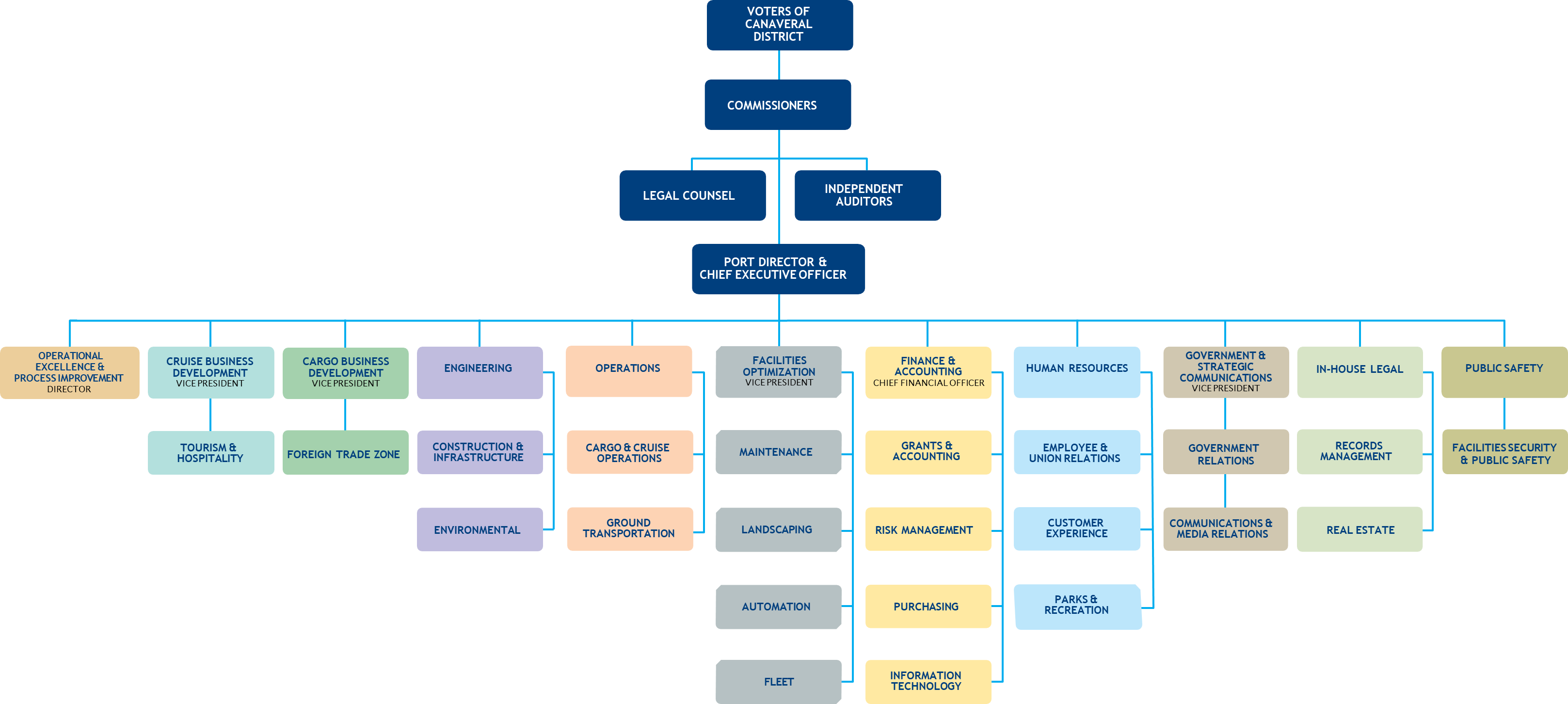

The Canaveral Port Authority, governing body of the Canaveral Harbor Port District, consists of five elected Commissioners. The Board meets on the third or fourth Wednesday of each month at 9:00 A.M. The meetings are held in the Board Room of the Port Authority office building located at 445 Challenger Road. In addition, special meetings and public hearings are scheduled throughout the year.

| Commissioner | Position | Years of Service | Term Expires |

|---|---|---|---|

| Micah Loyd | Chairman | 8 | 11/1/28 |

| Wayne Justice | Vice Chairman | 10 | 11/1/26 |

| Jerry Allender | Secretary/Treasurer | 14 | 11/1/26 |

| Kevin Markey | Commissioner | 3 | 11/1/28 |

| Fritz VanVolkenburgh | Commissioner | 2 | 11/1/26 |

Appointed Officials

| Name | Title | Years of Service |

|---|---|---|

| Capt. John W. Murray | Chief Executive Officer | 8 |

| Jeff Long | Chief Financial Officer | 1 |

| George Arocha | Director, Cargo & Container Operations | 10 |

| Peter Bergeron | Vice President, Public Safety & Security | 3 |

| Amanda Brailsford-Urbina | Vice President, HR, Recreation & Customer Experience | 8 |

| Bruce Cameron | Director, Cruise Operations | 2 |

| Samantha Cornelius | Vice President, Business Development, Cargo & Aerospace | 7 |

| William Crowe | Vice President, Engineering & Construction | 9 |

| Cory Dibble | Director, Public Safety & Security | 8 |

| Shannon Feeley | Director, Risk Management | 21 |

| Dave German | Vice President, Cruise Business Development | 19 |

| Donna Greenslade | Director, Human Resources | 20 |

| Michael Hoffmann | Director, Parks, Recreation & Customer Experience | 3 |

| AJ Jendroch | Director, Facilities & Maintenance | 11 |

| Debbie Joyce | Director, Grants & Capital Projects | 3 |

| Craig Langley | Vice President & General Counsel | 10 |

| Steven Linden | Director, Communications & Public Affairs | 7 |

| Mark Lorusso | Vice President, Information Technology | 13 |

| Diane Luensmann | Vice President, Government & Strategic Communications | 7 |

| Clyde Mathis | Vice President, Cruise & Cargo Operations | 10 |

| Mark Milisits | Director, Real Estate | 2 |

| Diana Mims-Reid | Controller | 24 |

| Bob Musser | Sr. Director, Port Environmental | 8 |

| Karen Pappas | Director, Procurement & Materials Management | 23 |

| Patricia G. Poston | Sr. Director, Finance | 27 |

| Marlene Sanchez | Director, Operational Excellence & Process Improvement | 12 |

| Steven Shelton | Vice President, Facilities Optimization | 1 |

March 25, 2025

To the Canaveral Port Authority Commissioners, Chief Executive Officer (CEO) and Citizens of the Canaveral Harbor Port District:

State law requires that all general-purpose local governments, including special districts, publish within nine months of the close of each fiscal year, a complete set of financial statements presented in conformity with U. S. general accepted accounting principles (GAAP) and audited in accordance with generally accepted auditing standards and Government Auditing Standards by a firm of licensed certified public accountants. Pursuant to that requirement, we hereby issue the annual comprehensive financial report of the Canaveral Port Authority for the fiscal year ended September 30, 2024.

This report consists of management’s representations concerning the finances of the Canaveral Port Authority (the Authority). Consequently, management assumes full responsibility for the completeness and reliability of all of the information presented in this report. To provide a reasonable basis for making these representations, management of the Authority has established a comprehensive internal control framework that is designed to: 1) protect the government’s assets from loss, theft, or misuse and 2) compile sufficient reliable information for the preparation of the Authority’s basic financial statements in conformity with GAAP. Because the cost of internal controls should not outweigh their benefits, the Authority’s comprehensive framework of internal controls has been designed to provide reasonable rather than absolute assurance that the financial statements will be free from material misstatement. As management, we assert that, to the best of our knowledge and belief, this financial report is complete and reliable in all material respects.

RSM US, LLP, a firm of licensed certified public accountants, has audited the Canaveral Port Authority’s basic financial statements. The goal of the independent audit was to provide reasonable assurance that the financial statements of the Authority for the fiscal year ended September 30, 2024, are free of material misstatement. The independent audit involved examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements; assessing the accounting principles used and significant estimates made by management; and evaluating the overall financial statement presentation. The independent auditor concluded, based upon the audit, that there was a reasonable basis for rendering an unmodified opinion that the Authority’s basic financial statements for the fiscal year ended September 30, 2024 are fairly presented. These statements are included as the first component of the financial section of this report.

GAAP requires that management provide a narrative introduction, overview, and analysis to accompany the basic financial statements in the form of Management’s Discussion and Analysis (MD&A). This letter of transmittal is designed to complement the MD&A and should be read in conjunction with it. The Canaveral Port Authority’s MD&A can be found immediately following the report of the independent auditor.

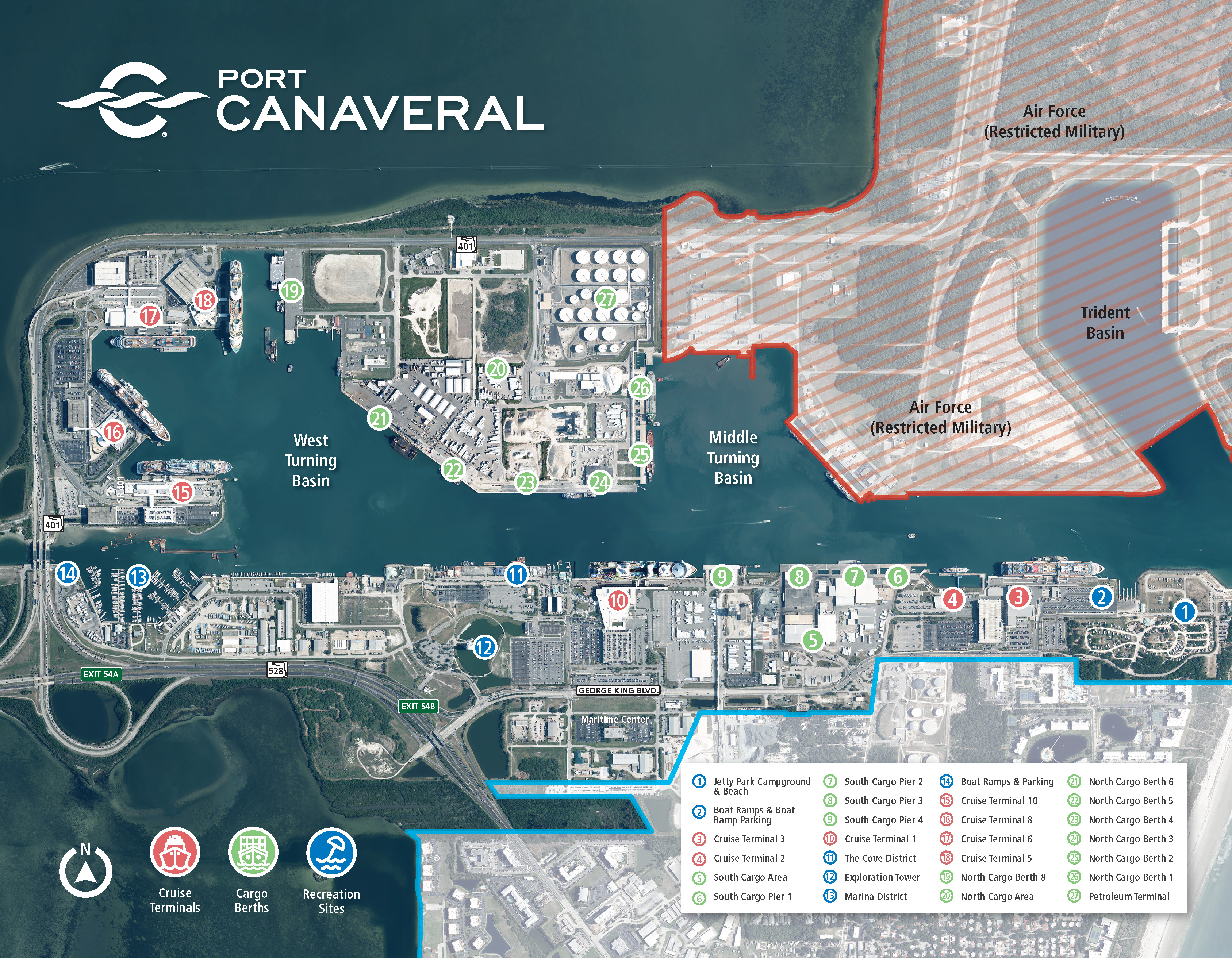

Profile of the Authority

Economic Conditions in Fiscal Year 2024

The information presented in the financial statements is perhaps best understood when it is considered from the broader perspective of the specific environment within which the Authority operates.

Local Economy

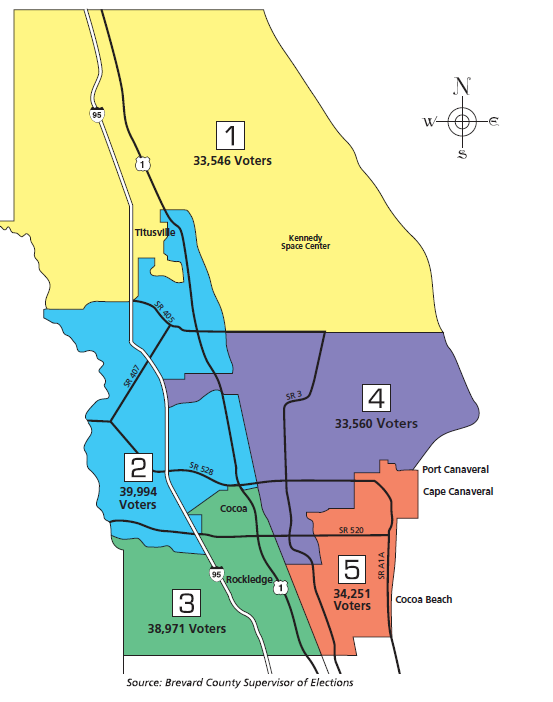

The Canaveral Harbor Port District encompasses approximately the northern two-thirds of Brevard County. The County is home to a number of large employers, both public and private. According to the U.S Department of Labor, Bureau of Labor Statistics, the Nation’s unemployment rate at September 2024 is estimated at 4.1%, the State of Florida unemployment rate is 3.3% and Brevard County Florida is 3.6%.

Economic Outlook

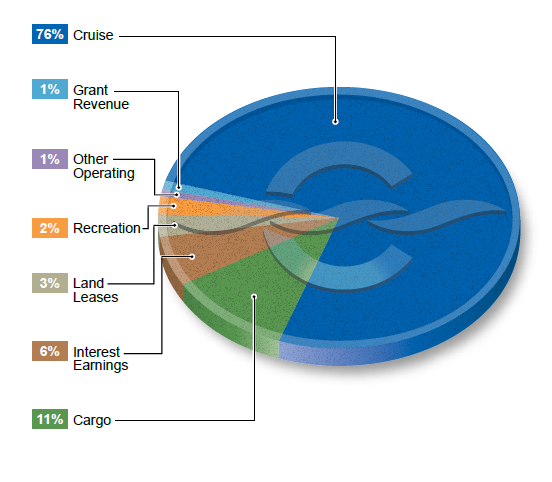

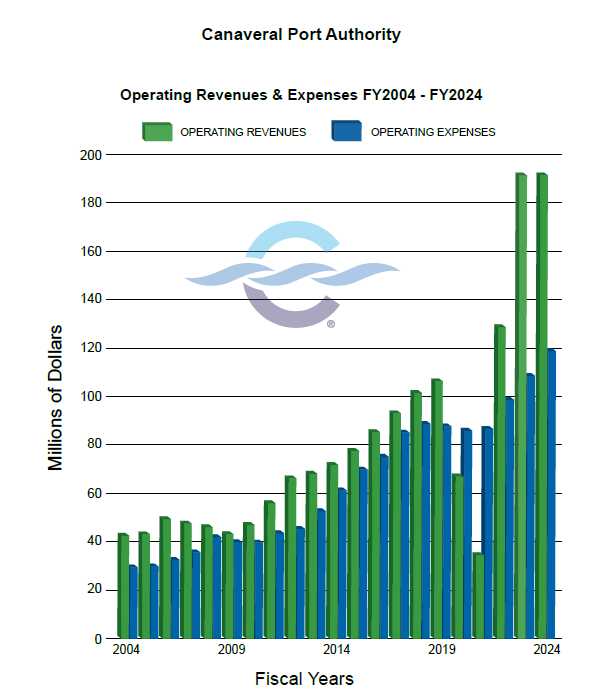

The Authority is strategically located on the central east coast of the state and enjoys a significant “drive-to” market for cruising. During Fiscal Year 2024, the Authority’s total operating revenue was $191.9 million.

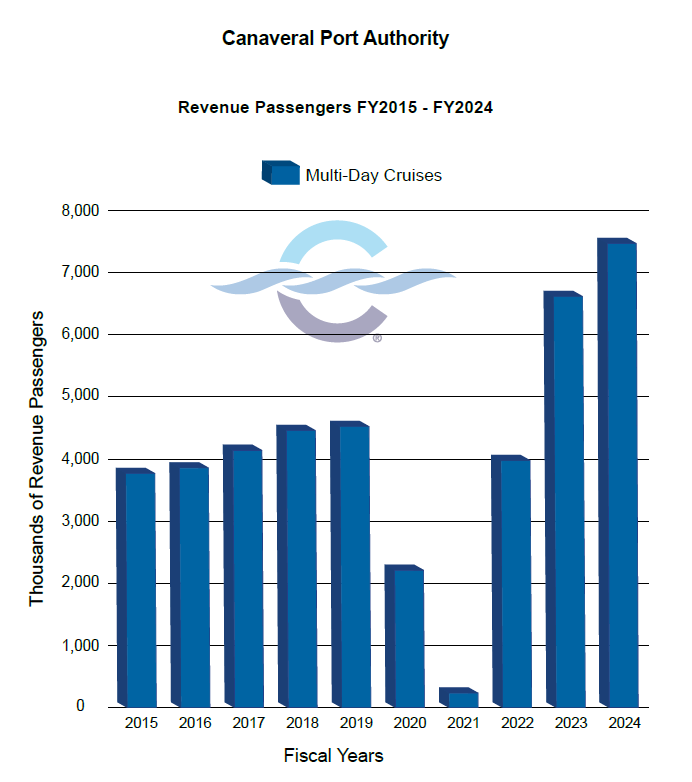

For Fiscal Year 2024, cruise revenue was $156 million and total multi-day revenue passengers were 7,592,535.

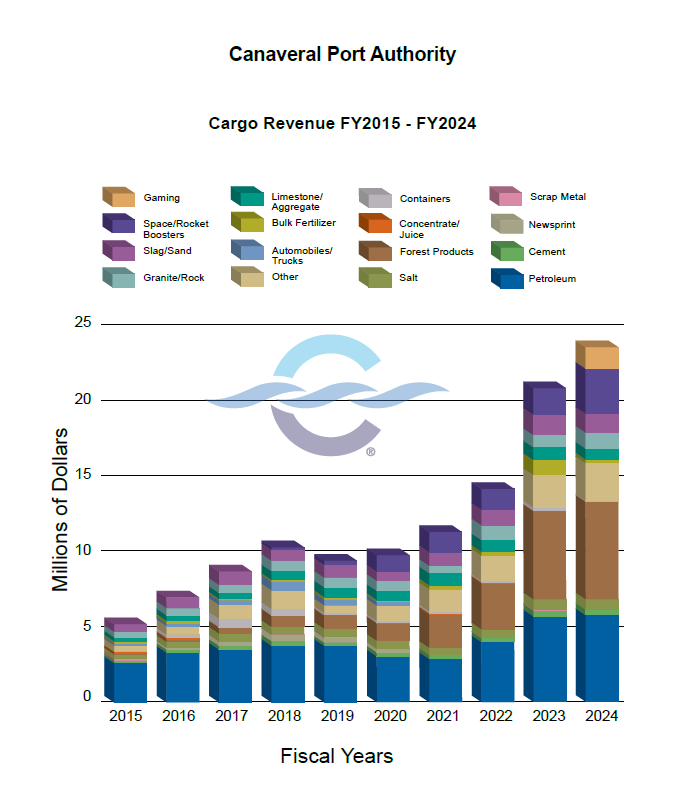

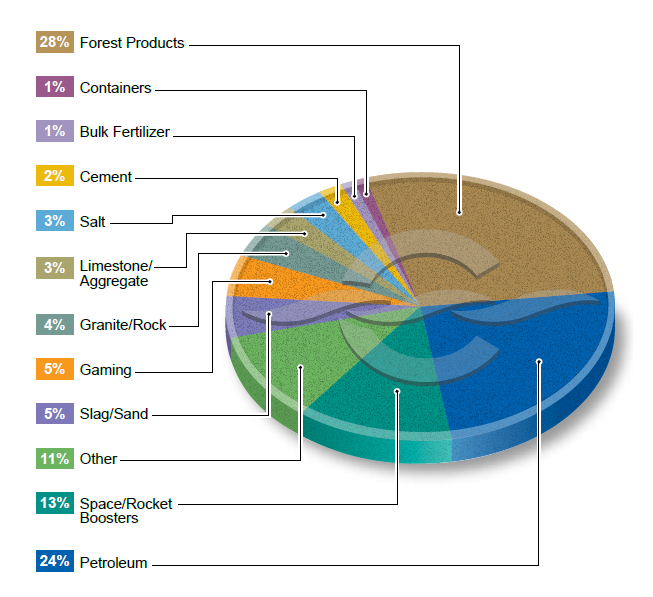

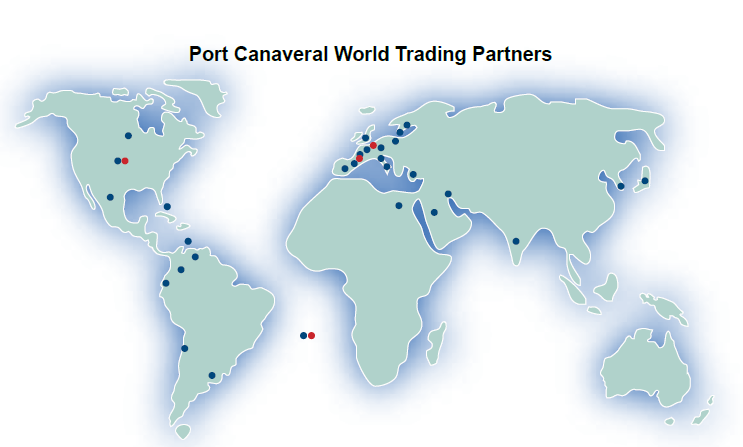

Cargo related revenue for Fiscal Year 2024 was $23 million which was based on ship related revenue of $17 million and cargo lease revenue of $6.2 million. The total tonnage of 6,551,621 included the commodities - petroleum, limestone, grantite, forest products and slag. These materials contribute to a diversified cargo base and supports construction and growth in Central Florida.

The Authority continues to implement security measures to ensure the safety of the traveling public as well as Port Canaveral tenants. The annual costs of these services was $13 million for FY2024.

Long-Term Financial Planning

In addition to the Authority’s operating budget process, a $500 million five-year capital plan has been developed to assess future needs. As part of this capital plan, projects are continuously evaluated to determine whether any new projects will yield an appropriate rate of return before any investment is considered when additional funding is needed. The Authority continues to invest its cash resources to achieve the desired results along with prudent borrowing policies using bond financing and bank debt. A key component of capital project analysis also includes the availbility of Federal and State agencies grant funding.

The Canaveral Harbor Port District, as presently structured, was created by House Bill Number 1136, Chapter 28922, from the Laws of Florida Special Acts of 1953, as amended and restated by Chapter 2003-335, Laws of Florida, Acts of 2003, and acts amendatory thereof and supplemental thereto. This bill created, organized and established a port district in Brevard County, Florida and designated the area as the Canaveral Harbor Port District. The Authority is a quasi-public governmental body, an independent special taxing district that is a political subdivision of the State of Florida. As such, it is not under the jurisdiction of Brevard County or any neighboring city.

The Authority has operated under the Commission-manager form of government since 1953. Five elected commissioners, representing the five Port districts, serve as a board of directors and have jurisdiction over all fiscal and regulatory policies and operations of the Port. Commissioners are chosen by the public via an at-large election and serve four-year terms. These terms are staggered, with three commissioners up for election at one time, and the remaining two up for election two years hence. As an independent special district of the State of Florida, the Authority is empowered to levy ad valorem taxes to finance expansion and operation, incur indebtedness through the sale of bonds or use of bank loans, establish tariff rates, negotiate for government grants, condemn necessary land, zone its land, and exercise police powers. The commission is responsible, among other things, for passing policies, adopting a budget, appointing committees, and hiring both the government’s manager (CEO) and attorney. The CEO’s authority and responsibilities are similar to those of both the manager of a local government and the president of a sizable private corporation. The major goals of the Authority are to give the residents of the area the benefits of low-cost ocean transportation, a foreign trade zone and to create economic opportunity and jobs. The Authority also provides substantial facilities for recreation for the local population and visitors alike.

The annual Operating and Capital Budgets serve as the foundation for the Authority’s financial planning and control. All departments of the Authority are required to submit budget requests to the CEO during June of each year. The CEO uses these requests as the starting point for developing a proposed budget. The Chief Financial Officer (CFO) then prepares and presents this proposed budget to the commission for review prior to September 30. The commission holds two public hearings on the proposed budget and adopts a final budget no later than September 30, the close of the Authority’s fiscal year (FY). The Operating Budget is prepared by functional department. Due to operating or unforeseen activities during the year, department heads may request modifications to their departmental budget. Any proposed changes to the overall total of the Operating Budget are approved by the commission at a public hearing. Changes to the Capital Budget are more fluid, but do require review by the commission.

Economic Conditions in Fiscal Year 2024

The information presented in the financial statements is perhaps best understood when it is considered from the broader perspective of the specific environment within which the Authority operates.

Local Economy

The Canaveral Harbor Port District encompasses approximately the northern two-thirds of Brevard County. The County is home to a number of large employers, both public and private. According to the U.S Department of Labor, Bureau of Labor Statistics, the Nation’s unemployment rate at September 2024 is estimated at 4.1%, the State of Florida unemployment rate is 3.3% and Brevard County Florida is 3.6%.

Economic Outlook

The Authority is strategically located on the central east coast of the state and enjoys a significant “drive-to” market for cruising. During Fiscal Year 2024, the Authority’s total operating revenue was $191.9 million.

For Fiscal Year 2024, cruise revenue was $156 million and total multi-day revenue passengers were 7,592,535.

Cargo related revenue for Fiscal Year 2024 was $23 million which was based on ship related revenue of $17 million and cargo lease revenue of $6.2 million. The total tonnage of 6,551,621 included the commodities - petroleum, limestone, grantite, forest products and slag. These materials contribute to a diversified cargo base and supports construction and growth in Central Florida.

The Authority continues to implement security measures to ensure the safety of the traveling public as well as Port Canaveral tenants. The annual costs of these services was $13 million for FY2024.

Long-Term Financial Planning

In addition to the Authority’s operating budget process, a $500 million five-year capital plan has been developed to assess future needs. As part of this capital plan, projects are continuously evaluated to determine whether any new projects will yield an appropriate rate of return before any investment is considered when additional funding is needed. The Authority continues to invest its cash resources to achieve the desired results along with prudent borrowing policies using bond financing and bank debt. A key component of capital project analysis also includes the availbility of Federal and State agencies grant funding.

Relevant Financial Policies

The Authority continues to follow financial policies in effect which includes policies governing budget, investment, internal controls, leasing land, travel, purchasing, and Commissioners minor expenses. These policies are reviewed annually, with amendments approved by the Board.

Major Initiatives

The Authority continues to expand and improve its cruise, cargo, recreational and real estate facilities, and infrastructure. For FY2024, the capital budget consisted of several major projects, including the multiyear rehabilitation of North Cargo Berth 4, Portwide Parking Improvements and Garages, Roads and Utility Improvements, Cruise Terminal 5 & 10 Upgrades, Mobile Harbor Cranes and Passenger Boarding Bridge Improvements. The total investment of these projects totaled $96.1 million. Some of the major projects that were completed during FY2024 include the purchase of a Mobile Harbor Crane at a cost of $7.7 million, Road and Parking Lot Improvements at a cost of $4.9 million, Improvements to Piers, Buildings, and Structures at a cost of $5.3 million, Maintenance Dredging at a cost of $4.8 million, Cruise Terminal Furniture/Equipment Upgrades at a cost of $4 million, and Passenger Boarding Bridge Upgrades at a cost of $3.8 million.

The Authority’s improvements are funded from existing cash flow as a result of the revenues from existing and projected cruise, cargo, and land lease operations, and Federal and State grants. The Port continues to seek federal and state assistance in the form of grants and capital improvement funding.

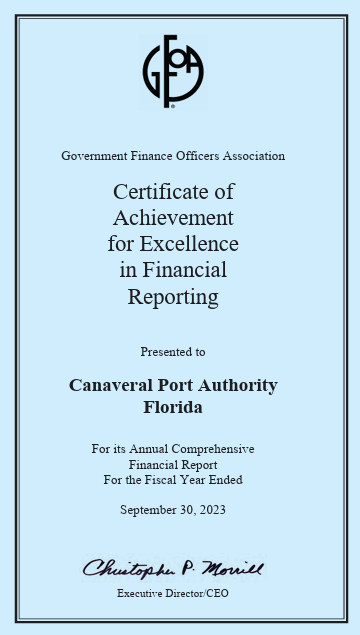

Awards and Acknowledgments

The Government Finance Officers Association of the United States and Canada (GFOA) awarded a Certificate of Achievement for Excellence in Financial Reporting to the Canaveral Port Authority for its annual comprehensive financial report for the fiscal year ended September 30, 2023. This was the thirty-third consecutive year that the Authority has received this prestigious award. In order to be awarded a Certificate of Achievement, the Authority published an easily readable and efficiently organized annual comprehensive financial report. This report must satisfy both generally accepted accounting principles and applicable legal requirements.

A Certificate of Achievement is valid for a period of one year only. We believe that our current annual comprehensive financial report continues to meet the Certificate of Achievement Program’s requirements and we are submitting it to the GFOA to determine its eligibility for another certificate.

The preparation of this report would not have been possible without the efficient and dedicated services of the entire staff of the Finance Department. I would like to extend my thanks to all members of the department who assisted and contributed to the preparation of this report, with special recognition given to Controller, Diana Mims-Reid. Thanks and appreciation are also extended to Raymond Jessee with his help on reviewing and coordinating this report and also to the firm of RSM US, LLP for their professional approach and high standards in the conduct of their independent audit of the Authority’s financial records and transactions.

Finally, I would also like to express my appreciation to the Canaveral Port Authority Board of Commissioners and CEO John Murray for their guidance and support throughout the year. I appreciate their interest and leadership in planning and conducting the financial operation of the Authority in a progressive and responsible manner.

Independent Auditor’s Report

Board of Commissioners Canaveral Port Authority Cape Canaveral, Florida

Report on the Audit of the Financial Statements

Opinion

We have audited the financial statements of the Canaveral Port Authority (the Authority) as of and for the year ended September 30, 2024, and the related notes to the financial statements, which collectively comprise the Authority’s basic financial statements as listed in the table of contents.

In our opinion, the accompanying financial statements referred to above present fairly, in all material respects, the financial position of the Authority, as of September 30, 2024, and the changes in financial position and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States (Government Auditing Standards). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Authority, and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Authority’s ability to continue as a going concern for 12 months beyond the financial statement date, including any currently known information that may raise substantial doubt shortly thereafter.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations or the override of internal control.

Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

- Exercise professional judgment and maintain professional skepticism throughout the audit.

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Authority’s internal control. Accordingly, no such opinion is expressed.

- Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

- Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Authority’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings and certain internal control-related matters that we identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the management's discussion and analysis and the schedule of changes in total OPEB liability be presented to supplement the basic financial statements. Such information is the responsibility of management and, although not a part of the basic financial statements, is required by the Governmental Accounting Standards Board who considers it to be an essential part of financial reporting for placing the basic financial statements in an appropriate operational, economic or historical context. We have applied certain limited procedures to the required supplementary information in accordance with GAAS, which consisted of inquiries of management about the methods of preparing the information and comparing the information for consistency with management's responses to our inquiries, the basic financial statements and other knowledge we obtained during our audit of the basic financial statements. We do not express an opinion or provide any assurance on the information because the limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

Supplementary Information

Our audit was conducted for the purpose of forming an opinion on the financial statements that collectively comprise the Authority's basic financial statements. The schedule of expenditures of federal awards and state financial assistance, as required by Title 2 U.S. Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards and Chapter 10.550, Rules of the Auditor General of the State of Florida are presented for purposes of additional analysis and are not a required part of the basic financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the basic financial statements. The information has been subjected to the auditing procedures applied in the audit of the basic financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the schedule of expenditures of federal awards and state financial assistance are fairly stated, in all material respects, in relation to the basic financial statements as a whole.

Other Information

Management is responsible for the other information included in the annual comprehensive financial report. The other information comprises the introductory and statistical sections, schedule of comparative revenues, expenses and changes in net position, schedule of comparative operating revenues by activity, the schedule of construction in progress and capital costs compared with budget (prior to transfer of completed projects to capital assets), and the schedule of insurance in force, but does not include the basic financial statements and our auditor's report thereon. Our opinion on the basic financial statements does not cover the other information, and we do not express an opinion or any form of assurance thereon.

In connection with our audit of the basic financial statements, our responsibility is to read the other information and consider whether a material inconsistency exists between the other information and the basic financial statements, or the other information otherwise appears to be materially misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the other information exists, we are required to describe it in our report.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated March 18, 2025, on our consideration of the Authority’s internal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts and grant agreements and other matters. The purpose of that report is solely to describe the scope of our testing of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinion on the effectiveness of the Authority’s internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards in considering Authority’s internal control over financial reporting and compliance.

Orlando, Florida March 18, 2025

As management of the Canaveral Port Authority (the Authority), we offer readers of the Authority's financial statements this narrative overview and analysis of the financial activities of the Authority for the fiscal year ended September 30, 2024. All amounts, unless otherwise indicated, are expressed in thousands of dollars.

Financial Highlights

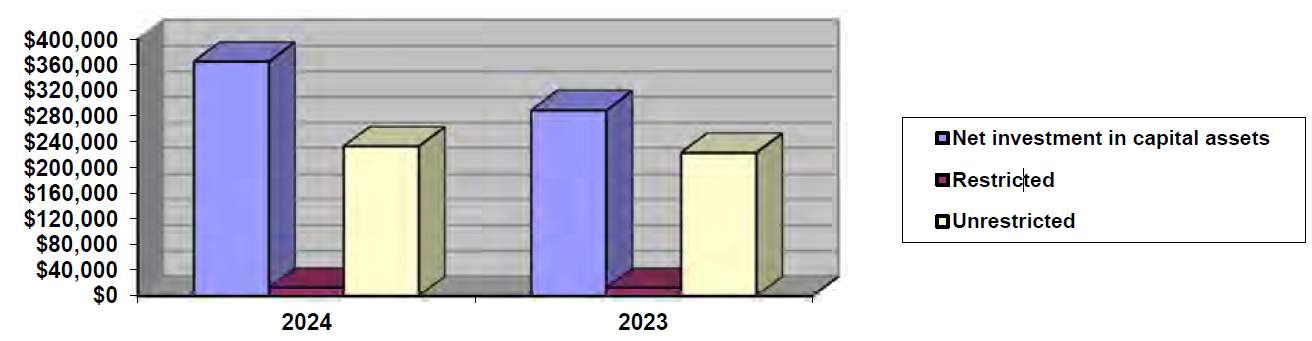

- The assets and deferred outflows of the Authority exceeded its liabilities and deferred inflows at the close of the most recent fiscal year by $611,483 (net position). Of this amount, $232,900 is the unrestricted net position and is available to meet the Authority's ongoing obligations to creditors.

- The Authority's total net position increased by $86,231. This consists of an increase in net investment in capital assets of $76,047, an increase in restricted net position of $173, and an increase in unrestricted net position of $10,011.

- At the end of the current fiscal year, the unrestricted net position was 175.5% of total expenses.

Overview of the Financial Statements

This discussion and analysis are intended to serve as an introduction to the Authority's basic financial statements. The Authority's basic financial statements are comprised of two components: enterprise financial statements and notes to the financial statements. This report also contains the required supplementary information, other supplementary information, and other information in addition to the basic financial statements themselves.

The basic financial statements report information about the Authority using the full accrual basis of accounting as utilized by similar business activities in the private sector. The basic financial statements include a statement of net position, a statement of revenues, expenses and changes in net position and a statement of cash flows.

The statement of net position presents information on all the Authority's assets and deferred outflows of resources, as well as liabilities and deferred inflows of resources, with the difference between the two groups reported as total net position. Over time, increases or decreases in net position may serve as a useful indicator of whether the financial position of the Authority is improving or deteriorating.

The statement of revenues, expenses and changes in net position presents information showing how the Authority's net position changed during the fiscal year. All changes in net position are reported as soon as the underlying event giving rise to the change occurs, regardless of the timing of related cash flows. Thus, revenues and expenses are reported in this statement for some items that will only result in cash flows in future fiscal periods.

The statement of cash flows presents changes in cash and cash equivalents from operational, financing, and investing activities. This statement presents cash receipt and disbursement information without consideration of the earnings event, when an obligation arises, or depreciation of capital assets.

The notes to the financial statements provide additional information that is essential to a full understanding of the data provided in the basic financial statements.

In addition to the basic financial statements and accompanying notes, this report also presents other required supplementary information, other supplementary information, and other information.

Financial Analysis

As noted earlier, net position may serve over time as a useful indicator of the Authority's financial position. The following table reflects the condensed statements of net position as of September 30:

The following table reflects the condensed statements of net position as of September 30:

| 2024 | 2023 | Change Amount | Change % | ||||

|---|---|---|---|---|---|---|---|

| Current and other assets | $ | 308,461 | $ | 307,196 | $ | 1,265 | 0.4% |

| Capital assets | 743,763 | 676,832 | 66,931 | 9.9% | |||

| Total assets | 1,052,224 | 984,028 | 68,196 | 6.9% | |||

| Deferred outflows of resources | 356 | 480 | (124) | -25.8% | |||

| Current liabilities | 52,394 | 48,922 | 3,472 | 7.1% | |||

| Noncurrent liabilities | 348,555 | 366,839 | (18,284) | -5.0% | |||

| Total liabilities | 400,949 | 415,761 | (14,812) | -3.6% | |||

| Deferred inflows of resources | 40,147 | 43,495 | (3,348) | -7.7% | |||

| Net position: | |||||||

| Net investment in capital assets | 365,479 | 289,432 | 76,047 | 26.3% | |||

| Restricted | 13,104 | 12,931 | 173 | 1.3% | |||

| Unrestricted | 232,900 | 222,889 | 10,011 | 4.5% | |||

| Total net position | $ | 611,483 | $ | 525,252 | $ | 86,231 | 16.4% |

Current assets increased because of a strong year of cruise operations with 7.6 million passengers. By far the largest portion (59.8%) of the Authority's net position as of September 30, 2024, reflects its investment in capital assets (e.g., land, buildings, improvements, equipment, intangibles and construction in progress); less any related debt used to acquire those assets that are still outstanding. These assets are not available for future spending. Although the Authority's investment in its capital assets is reported net of related debt, it should be noted that the resources needed to repay this debt must be provided from operations, since the capital assets themselves cannot be used to liquidate these liabilities. At the end of the current fiscal year, the Authority's net investment in capital assets increased by $76,047.

In addition, a portion (2.1%) of the Authority's net position as of September 30, 2024, represents the reserve for maximum debt service restricted in accordance with existing bond covenants. The remaining balance of unrestricted net position may be used to meet the Authority's ongoing obligations to creditors. At the end of the current fiscal year, the Authority's unrestricted net position increased by $10,011.

Net Position

The Authority's total net position decreased by $86,231 during the current fiscal year. Of this amount, an increase of $71,585 represents net income before capital contributions. The remaining increase of $14,646 represents the capital contributions (grant proceeds) from federal and state sources. There is no assurance that these capital contributions from other sources will continue in the future.

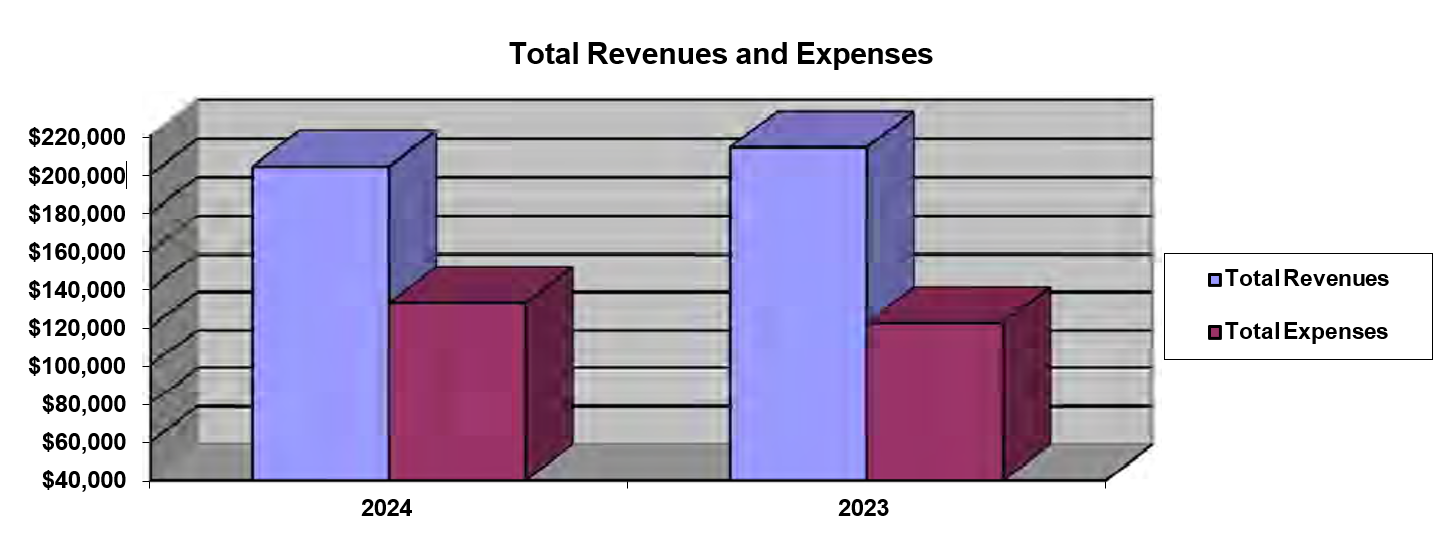

The following table shows condensed revenue and expense data for the years ended September 30:

| 2024 | 2023 | Change Amount | Change % | ||||

| Operating revenues: Cruise | $ 156,032 | $ 158,015 | $ (1,983) | -1.3% | |||

| Cargo | 23,216 | 20,539 | 2,677 | 13.0% | |||

| Leases | 5,749 | 6,196 | (447) | -7.2% | |||

| Other | 6,855 | 7,050 | (195) | -2.8% | |||

| Total operating revenues | 191,852 | 191,800 | 52 | 0.0% | |||

| Non-operating revenues: | |||||||

| Investment earnings | 11,332 | 7,064 | 4,268 | -60.4% | |||

| Other | 1,082 | 15,154 | (14,072) | -92.9% | |||

| Total non-operating revenues | 12,414 | 22,218 | (9,804) | -44.1% | |||

| Total revenues | 204,266 | 214,018 | (9,752) | -4.6% | |||

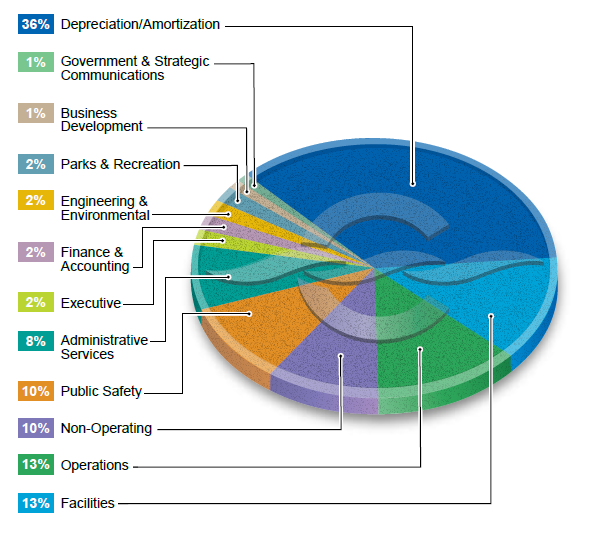

| Operating expenses: | |||||||

| Operations, facilities and public safety | 46,654 | 38,947 | 7,707 | 19.8% | |||

| Executive, finance and administration | 16,383 | 14,062 | 2,321 | 16.5% | |||

| Engineering and environmental | 2,419 | 2,315 | 104 | 4.5% | |||

| Other | 5,780 | 5,656 | 124 | 2.2% | |||

| Depreciation and amortization | 47,837 | 47,855 | (18) | 0.0% | |||

| Total operating expenses | 119,073 | 108,835 | 10,238 | 9.4% | |||

| Non-operating expenses: Interest | 12,102 | 12,219 | (117) | -1.0% | |||

| Loss on disposal of capital assets | 1,210 | 101 | 1,109 | 0.0% | |||

| Hurricane repairs | 138 | 996 | (858) | 0.0% | |||

| Other | 158 | 158 | - | 0.0% | |||

| Total non-operating expenses | 13,608 | 13,474 | 134 | 1.0% | |||

| Total expenses | 132,681 | 122,309 | 10,372 | 8.5% | |||

| Income before contributions | 71,585 | 91,709 | (20,124) | -21.9% | |||

| Capital contributions | 14,646 | 30,442 | (15,796) | -51.9% | |||

| Change in net position | 86,231 | 122,151 | (35,920) | -29.4% | |||

| Net position beginning | 525,252 | 403,101 | 122,151 | 30.3% | |||

| Net position ending | $ 611,483 | $ 525,252 | $ 86,231 | 16.4% |

Key elements of the increase in net position for the fiscal year ended September 30, 2024, are as follows.

- Total operating fees and charges for services had a 0% overall change for the year. Included in the total operating revenue was cruise operations (including parking), recreation (Jetty Park), and leases had a decrease of 1.3%, 2.8% and 7.2%, respectively. These decreases were offset by a 13% increase in operating revenues for cargo.

- Overall, non-operating revenues decreased, which included investment earnings, grant revenue and gains on sale of assets or legal settlements. Investment earnings (loss) increased by $11.3 million due to increased investments and rising interest rates.

- Capital contributions from federal and state grants for capitalized projects decreased during the current fiscal year by $15.8 million. This decrease was due to the completion of North Cargo Berth 3 and several security projects.

Capital Asset and Debt Administration

Capital assets: The Canaveral Port Authoritys capital assets as of September 30, 2024, and 2023, amount to $743,763 and $676,832, respectively, (net of accumulated depreciation). These balances include land, buildings, improvements, equipment, intangibles and construction in progress. The total increase in the Authoritys capital assets was 9.9% for fiscal year 2024.

Major capital asset events during the current fiscal year included the following:

- Construction continued on several major projects for the Authority including improvements to Piers and Buildings, Portwide Parking Improvements & Garages, Roads and Utility Improvements, Cruise Terminal 5 & 10 Upgrades, North Cargo Berth 4 Improvements and Passenger Boarding Bridge Improvements. The total investment in these projects totaled $96,133 and were offset by the total value of projects completed and moved from Construction in Progress to capital assets of $35,554.

Several major projects included in Construction in Progress on September 30, 2023, were completed during fiscal year 2024 including:

- Mobile Harbor Crane -1 $7,704

- Maintenance Dredging at $4,754

- Road Improvements & Bridge Renovation at $7,602

- Improvements to Piers, Buildings, Structures at $5,306

- Cruise Terminal Furniture/Equipment at $4,064

Commitments for the repair, modification, improvements, materials and new construction of Authority owned property at September 30, 2024, totaled $59,497.

Additions for the year ended September 30, 2024, were offset by depreciation expense of $46,587 and amortization expense of $1,250.

The following table shows capital assets by category for the years ended September 30:

| 2024 | 2023 | Change Amount | Change % | ||||

| Land | $ 5,471 | $ 5,471 | $ - | 0.0% | |||

| Buildings | 168,051 | 181,987 | (13,936) | -7.7% | |||

| Improvements other than | |||||||

| buildings | 404,015 | 415,244 | (11,229) | -2.7% | |||

| Equipment | 38,139 | 29,939 | 8,200 | 27.4% | |||

| Intangibles | 4,763 | 1,000 | 3,763 | 376.3% | |||

| Construction in progress | 123,324 | 43,191 | 80,133 | 185.5% | |||

| Total | $ 743,763 | $ 676,832 | $ 66,931 | 9.9% |

Additional information on the Canaveral Port Authoritys capital assets can be found in Note 3.D. in this report.

Long-term debt: On September 30, 2024, the Canaveral Port Authority had total bonded debt outstanding of $335,686 and lines of credit with outstanding balances of $5 million and $16 million. The Canaveral Port Authoritys debt represents bonds secured solely by operating revenues (i.e., revenue bonds).

The Canaveral Port Authoritys total revenue and direct borrowing bonds decreased by $16,910 (4.8%). The major factor for the decrease during the current year was due to regular scheduled principal payments and no new issuances this year.

Additional information on the Canaveral Port Authoritys long-term debt can be found in Note 3.G. and 3.H. in this report.

Economic Factors and Next Years Budgets and Rates

For FY2025, the Authority has budgeted the following:

- Charges for services of $211 million due to projected cruise and cargo related business.

- Operating expenses of $136 million (including $51 million for depreciation) which contain funding for cruise activities.

- Non-operating revenues of $9 million, which is mostly investment earnings.

Requests for Information

This financial report is designed to provide a general overview of the Canaveral Port Authoritys finances for all those with an interest in the Authoritys finances. Questions concerning any of the information provided in this report or requests for additional financial information should be addressed to the Finance Department, Canaveral Port Authority, 445 Challenger Road, Suite 301, Cape Canaveral, Florida 32920.

Assets

| Current assets: | |

| Cash and cash equivalents | $ 184,959,046 |

| Cash and cash equivalents - restricted | 2,978,641 |

| Investments | 27,008,051 |

| Accounts receivable trade, net | 10,153,064 |

| Interest receivable | 357,859 |

| Lease receivable | 3,674,714 |

| Prepaid expenses | 4,602,478 |

| Due from other governmental units | 12,636,686 |

| Inventory | 771,565 |

| Deposits and other receivables, current | 18,630 |

| Total current assets | 247,160,734 |

| Noncurrent assets: | |

| Cash and cash equivalents - restricted | 13,104,047 |

| Lease receivable | 37,539,605 |

| Deposits and other receivables, long-term | 10,656,302 |

| Capital assets (net of accumulated depreciation | |

| and amortization): | |

| Land (non-depreciable) | 5,470,630 |

| Buildings | 168,051,046 |

| Improvements other than buildings | 404,015,575 |

| Equipment | 38,139,657 |

| Intangible assets | 4,762,766 |

| Construction in progress (non-depreciable) | 123,323,638 |

| Total noncurrent assets | 805,063,266 |

| Total assets | 1,052,224,000 |

| Deferred outflows of resources: Other post-employment benefits (OPEB) related amounts | 356,024 |

| Total deferred outflows of resources | 356,024 |

(Continued)

| Liabilites | Amount |

|---|---|

| Current liabilities | |

| Accounts payable and accrued expenses | $27,781,326 |

| Unearned revenue | 786,712 |

| Payroll and sales taxes payable | 307,550 |

| Revenue bonds and direct borrowing bonds, current portion | 17,036,000 |

| Accrued interest payable | 1,537,472 |

| Other liabilities, current portion | 2,591,415 |

| Payable from restricted assets: | |

| • Accrued interest payable | 2,093,488 |

| • Revenue bonds payable, current portion | 260,000 |

| Total current liabilities | 52,393,963 |

| Noncurrent liabilities | |

| Revenue bonds and direct borrowing bonds, less current portion | 323,146,997 |

| Compensated absences, less current portion | 1,677,982 |

| Lines of credit | 21,000,000 |

| Total OPEB liability | 1,321,371 |

| Other liabilities, long-term portion | 1,409,107 |

| Total noncurrent liabilities | 348,555,457 |

| Total liabilities | 400,949,420 |

| Deferred inflows of resources | |

| Leases | 38,762,634 |

| OPEB related amounts | 1,384,522 |

| Total deferred inflows of resources | 40,147,156 |

| Net position | |

| Net investment in capital assets | 365,479,123 |

| Restricted for debt service | 13,104,047 |

| Unrestricted | 232,900,278 |

| Total net position | 611,483,448 |

See notes to financial statements.

| Description | Amount |

|---|---|

| Operating revenues | |

| Cruise | $156,032,210 |

| Cargo | 23,216,396 |

| Leases | 5,748,471 |

| Other | 6,854,478 |

| Total operating revenues | 191,851,555 |

| Operating expenses | |

| Operations | 16,701,581 |

| Facilities | 16,879,038 |

| Parks and recreation | 2,126,768 |

| Public safety | 13,073,227 |

| Fire training facility | 379,211 |

| Commission | 327,920 |

| Executive | 3,089,607 |

| Finance and accounting | 2,198,283 |

| Administrative services | 11,090,544 |

| Engineering and environmental | 2,418,545 |

| Business development | 1,088,201 |

| Real estate | 397,462 |

| Government and strategic communications | 1,607,136 |

| Depreciation | 46,587,231 |

| Amortization | 1,249,788 |

| Total operating expenses | 119,072,662 |

| Operating income | 72,778,893 |

| Non-operating revenues | |

| Investment earnings | 11,332,065 |

| Grant revenue | 1,010,505 |

| Gain on sale of capital assets | 71,200 |

| Total non-operating revenues | 12,413,770 |

| Non-operating expenses | |

| Interest expense | 12,101,576 |

| Loss on disposal of capital assets | 1,210,024 |

| Hurricane repairs | 137,881 |

| Other non-operating expenses | 158,322 |

| Total non-operating expenses | 13,607,803 |

| Income before capital contributions | 71,584,860 |

| Capital contributions | 14,646,267 |

| Change in net position | 86,231,127 |

| Net position, beginning of year | 525,252,321 |

| Net position, end of year | 611,483,448 |

See notes to financial statements.

| Description | Amount |

|---|---|

| Cash flows from operating activities | |

| Cash received from customers and users | $187,219,660 |

| Cash paid to suppliers for goods and services | (51,816,228) |

| Cash payments to employees for services | (20,871,507) |

| Net cash provided by operating activities | 114,531,925 |

| Cash flows from non-capital financing activities | |

| Cash received from grants | 1,398,534 |

| Net cash provided by non-capital financing activities | 1,398,534 |

| Cash flows from capital and related financing activities | |

| Interest paid on revenue bonds and direct borrowing bonds | (12,472,323) |

| Lease interest payments on leases | 1,300,165 |

| Principal paid on revenue bonds and direct borrowing bonds | (16,910,000) |

| Acquisition and construction of capital assets | (112,689,708) |

| Payments made on lines of credit | (2,900) |

| Proceeds from sale of capital assets | 71,200 |

| Capital contributions | 30,473,473 |

| Net cash used in capital and related financing activities | (110,230,093) |

| Cash flows from investing activities | |

| Interest received on investments | 10,499,819 |

| Purchase of investments | (905,296) |

| Net cash provided by investing activities | 9,594,523 |

| Net change in cash and cash equivalents | 15,294,889 |

| Cash and cash equivalents | |

| Beginning of year | 185,746,845 |

| End of year | 201,041,734 |

(Continued)

| Reconciliation of operating income to net cash provided by operating activities: | |

| Operating income | $ 72,778,893 |

| Adjustment to reconcile operating income to net cash provided by operating activities: | |

| Depreciation expense | 46,557,231 |

| Amortization expense | 1,249,788 |

| (Increase) decrease in assets and deferred outflows: | |

| Accounts receivable | 2,677,251 |

| Inventory | (120,804) |

| Lease receivables | 945,252 |

| Deposits and other receivables | (4,819,620) |

| Prepaid expenses | (623,276) |

| Deferred outflows of resources – OPEB | 72,908 |

| Increase (decrease) in liabilities and deferred inflows: | |

| Accounts payable and accrued expenses | 2,487,636 |

| Unearned revenue | (45,927) |

| Compensated absences | 5,506 |

| Total OPEB liability | 61,073 |

| Deferred inflows of resources – leases | (3,202,870) |

| Deferred inflows of resources – OPEB | (144,612) |

| Other liabilities | (3,192,651) |

| Payroll and sales tax payable | 46,149 |

| Total adjustments | 41,753,032 |

| Net cash provided by operating activities | $ 114,531,925 |

During 2024, the Authority recorded an unrealized gain on investments of $832,246.

During 2024, the Authoritys balance in due from other governmental units relating to capital contributions is $12,570,021.

On September 30, 2024, the Authority had capital asset additions included in accounts payable of $17,101,192.

| Notes to Financial Statements | ||

| Note | Contents | PAGE |

| 1. | Summary of Significant Accounting Policies | |

| A. Reporting Entity | 9 | |

| B. Measurement, Focus, Basis of Accounting and Financial Statement Presentation | 9 | |

| C. Assets, Deferred Outflows, Liabilities, Deferred Inflows and Net Position | 9 | |

| D. Revenues and Expenses | 13 | |

| E. Estimates | 13 | |

| 2. | Budgetary Information | 14 |

| 3. | Detail Notes | |

| A. Cash and Cash Equivalents and Investments | 15 | |

| B. Restricted Cash and Cash Equivalents | 18 | |

| C. Leases | 18 | |

| D. Capital Assets | 20 | |

| E. Accounts Payable and Accrued Expenses | 20 | |

| F. Other Liabilities | 20 | |

| G. Revenue Bonds and Direct Borrowing Bonds | 21 | |

| H. Lines of Credit | 26 | |

| I. Changes in Long-Term Liabilities | 27 | |

| J. Restricted Net Position | 27 | |

| K. Defined Contribution Plan | 27 | |

| L. Other Post-Employment Benefits | 28 | |

| M. Major Customers | 31 | |

| N. Risk Management | 31 | |

| O. Concentration – Collective Bargaining Unit | 31 | |

| P. Capital Contributions | 31 | |

| 4. | Commitments and Contingencies | |

| A. Construction | 32 | |

| B. Litigation | 32 | |

| C. Grants Programs | 32 | |

| 5. | Future Accounting Pronouncements | 33 |

Note 1. Summary of Significant Accounting Policies

A. Reporting Entity

The Canaveral Port Authority (the Authority) is an independent special taxing Authority and a political subdivision of the state of Florida (the State) which was established in 1953 by Chapter 28922, Laws of Florida, and Special Acts of 1953, as amended in 2014 (the Enabling Act). The governing body of the Authority is the Board of Commissioners (Board) composed of one commissioner elected from each of the five districts created by the Enabling Act.

B. Measurement Focus, Basis of Accounting and Financial Statement Presentation

The Authority is a special purpose government entity engaged in a business-type activity which operates as a single enterprise fund for the presentation of its financial statements. Enterprise fund financial statements are reported using the economic resources measurement focus and the accrual basis of accounting. Revenues are recorded when earned and expenses are recorded when a liability is incurred, regardless of the timing of related cash flows.

The Authority operates as an enterprise fund that accounts for the construction, operation, and maintenance of the Authority. An enterprise fund is a type of proprietary fund that provides services to the general public. This fund is used to account for the acquisition, operation and maintenance of governmental facilities and services which are entirely or predominantly self-supported by user charges. The operations of the Authority are accounted for in such a manner as to show a profit or loss, similar to comparable private enterprises.

Proprietary funds distinguish operating revenues and expenses from non-operating items. Operating revenues and expenses result from providing services and producing and delivering goods in connection with a proprietary fund's principal ongoing operations. The principal operating revenues of the Authority are fees and charges for cruise ships, cargo ships and land leases. Operating expenses include costs to operate and maintain facilities of the Authority, administrative expenses and depreciation and amortization expenses related to long-lived assets. All revenues and expenses not meeting these definitions are reported as non-operating revenues and expenses.

When both restricted and unrestricted resources are available for use, it is the Authority's policy to use restricted resources first, then unrestricted resources as they are needed.

C. Assets, Deferred Outflows, Liabilities, Deferred Inflows and Net Position

1. Cash and Cash Equivalents

Florida state statutes authorize the government to invest in the Local Government Surplus Funds Trust Fund (Florida PRIME), an external investment pool, or any intergovernmental investment pool authorized pursuant to the Florida Interlocal Cooperation Act, Securities and Exchange Commission (SEC) registered money market funds with the highest credit quality rating, interest-bearing time deposits or savings accounts in qualified public depositories and direct obligations of the U.S. Treasury.

Florida PRIME is administered by the Florida State Board of Administration, who provides regulatory oversight. The Authority's investment in Florida PRIME is reported at amortized cost. The fair value of the Authority's position in Florida PRIME is equal to the value of pooled shares. The Authority also invests in Florida Public Assets for Liquidity Management (PALM). PALM is a common law trust organized under the laws of the state of Florida and is a local government investment pool. At September 30, 2024, the fair value of $1 net asset value (NAV).

Cash and cash equivalents include cash deposits and short-term investments with original maturities of three months or less from the date of acquisition.

2. Accounts and Other Receivables

Management considers most accounts and other receivables to be fully collectible; however, the Authority has created an allowance for those where, based upon historical attempts at collection, it deems collection to be unlikely. The allowance for trade receivables as of September 30, 2024, was $75,000. All other receivables were deemed fully collectible as of September 30, 2024.

3. Investments

The Authority's investments are reported at fair value using the quoted market price or other fair value techniques as required by the Governmental Accounting Standards Board (GASB) Statement No. 72, Fair Value Measurements (GASB 72). Fair value is defined by GASB 72 as the price that would be received to sell an asset or to transfer a liability in an orderly transaction between market participants at the measurement date. Categories within the fair value hierarchy include: Level 1 inputs are quoted prices in active markets for identical assets, Level 2 inputs are significant other observable inputs, and Level 3 are unobservable inputs.

As of September 30, 2024, the Authority reported investments at fair value. Fair value for all the Authority's investments in debt was measured using Level 1 and Level 2 techniques. Florida PRIME is valued at amortized cost and PALM is measured at fair value using NAV.

4. Leases

The Authority has entered into various lessor arrangements with tenants for the use of warehouses, terminals, offices, and land at the Authority. For certain regulated leases and short-term leases, the Authority recognizes rental income based on the provisions of the lease agreement in the statement of revenues, expenses and changes in net position.

For other lessor arrangements, the Authority recognizes a lease receivable and a deferred inflow of resources in the statement of net position. The Authority recognizes a lease receivable and a deferred inflow of resources at the commencement of the lease term, with certain exceptions for leases of assets held as investments, certain regulated leases, short-term leases and leases that transfer ownership of the underlying assets. The lease receivable is measured at the present value of the lease payments expected to be received during the lease term. The deferred inflow of resources is measured as the value of the lease receivable in addition to any payments received at or before the commencement of the lease term that relate to future periods. Lease receivable is reduced as payments are received, applying principal against receivable and interest to revenue, based on the amortization schedule of the lease term. Interest revenue on a straight-line basis over the life of the lease term.

The Authority uses the following estimates and judgments to measure the GASB 87, Leases (GASB 87) leases:

- Discount Rate: The Authority uses its incremental borrowing rate to discount the expected lease receipts to present value based on the terms of the leases.

- Lease Term: The lease term includes the non-cancelable lease period, plus: 1) periods for which the Authority has a unilateral option to extend and is reasonably certain to exercise such option, or 2) periods after an optional termination date if the Authority is reasonably certain not to exercise the termination option.

- Lease Receipts: Measurement of the lease receivable includes fixed payments and, as applicable, variable fixed in substance payments, residual value guarantee payments that are fixed in substance and any lease incentives payable to the lessee.

5. Prepaid Expenses

Prepaid expenses consist of payments to vendors which reflect costs applicable to future accounting periods. Prepaid expenses are recorded as expenditures over the period of their economic benefit.

6. Restricted Cash and Cash Equivalents

Debt proceeds and funds set aside for payment of revenue bonds and construction projects are classified as restricted assets on the statement of net position because their use is limited by applicable bond indentures.

7. Inventory

Inventory is stated at the lesser of cost or market using the first-in, first-out inventory method.

8. Capital Assets

Capital assets are defined by the Authority as assets with an initial cost of more than $5,000 and an estimated useful life in excess of one year. Such assets are recorded at cost, if purchased, and at acquisition value at date of gift, if donated. Major additions are capitalized while maintenance and repairs, which do not improve or extend the life of the respective assets, are charged to expense. Assets received in aid of construction are credited to capital contributions and do not reduce the cost of the assets acquired with such contributions. Costs associated with deepening and widening the channel increase the potential service utility of the port and are recorded as a non-depreciable capital asset.

Depreciation is recognized on the straight-line method over the estimated useful lives of the assets. The following estimated useful lives are used for depreciation purposes:

| Classification | Range of Lives (Years) |

| Buildings | 30 |

| Improvements other than buildings | 5-40 |

| Equipment | 3-20 |

The Authority recognizes amortization on intangible assets as follows:

| Classification | Range of Lives (Years) |

| Computer software | 3-5 |

| Trademarks | 5 |

| Risk assessment plan | 5 |

| Master plan | 7 |

9. Deferred Outflows of Resources

In addition to assets, the statement of net position includes a separate section for deferred outflows of resources. This separate financial statement section, deferred outflows of resources, represents a consumption of net assets that applies to future periods and so will not be recognized as an outflow of resources (expenses) until that time. The Authority currently reports losses on bond refunding and items related to other post-employment benefits (OPEB) in this section.

10. Compensated Absences

All permanent employees of the Authority are eligible for annual leave. Each employee working a normal work week shall earn annual leave according to the employee's length of service. All annual leave earned is accrued when earned in the statement of net position. There is no liability for unpaid accumulated sick leave since the Authority does not have a policy to pay such amounts upon termination.

11. Other Post-Employment Benefits (OPEB)

The Authority obtains actuarial valuation reports for its postemployment benefit plan and records the OPEB liability as required under GASB 75, Accounting and Financial Reporting for Post-Employment Benefits Other Than Pensions. Disclosure information is reported in GASB 75 is found in Note 3.L.

12. Unearned Revenue

Resources that do not meet the revenue recognition requirements (not earned) are recorded as unearned revenue in the statement of net position.

13. Deferred Inflows of Resources

In addition to liabilities, the statement of net position includes a separate section for deferred inflows of resources. This separate financial statement section, deferred inflows of resources, represents an acquisition of net assets that applies to a future period and so will not be recognized as an inflow of resources (revenue) until that time. The Authority currently reports items related to OPEB and leases in this section.

14. Net Position - Net Investment in Capital Assets

The net investment in capital assets component of net position consists of capital assets, net of accumulated depreciation, reduced by the outstanding balance of bonds, notes or other borrowings that are attributable to the acquisition, construction or improvements of those assets and any deferred losses on bond refunding.

15. Net Position - Restricted

The Authority's statement of net position reports a restriction on net position that is maintained for a specific purpose. The nature and purpose of this restriction represent, in accordance with legal restrictions, amounts for payment of principal and interest maturing in later years.

16. Net Position - Unrestricted

This category represents the net position of the Authority, which is not restricted for any project or other purpose.

D. Revenues and Expenses

1. Operating Revenues and Expenses

2. Grants

Grants restricted for capital acquisition and construction are recorded as capital contributions. Other grant revenue is classified as non-operating revenue. They are considered earned when all applicable eligibility requirements have been met, and it is earned by the Authority.

E. Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets, deferred outflows, liabilities and deferred inflows, and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Note 2. Budgetary Information

The Authority's Enabling Act requires adoption of an annual operating budget. The Board adopts an annual operating and capital improvement budget resolution prior to September 30, for the next ensuing fiscal year. The Authority's budgets are prepared on the accrual basis of accounting which is consistent with U.S. GAAP. Operating budgets for the enterprise fund are based on the level of service expectations. Capital improvement projects are budgeted to provide control over authorized project expenses and ensure legal compliance.

Budget control is maintained at the departmental level. Actions which change the annual budget must be authorized by the Board. Budget amounts have been adjusted for legally authorized revisions of the annual budgets approved during the year.

The Authority has statutory authority to levy ad valorem taxes up to three (3) mills annually on all taxable property within the Authority's district boundaries for operation, maintenance, and improvement of Authority facilities. The Authority has not levied property taxes since 1986 and does not expect to do so in the foreseeable future.

Note 3. Detail Notes

A. Cash and Cash Equivalents and Investments

On September 30, 2024, the carrying amount of the Authority's recorded deposits with financial institutions was $63,429,705, and the bank balance was $62,614,360. In addition, the Authority held $500 of petty cash on September 30, 2024.

The investing of public funds in Florida PRIME is governed by Section 218.407, Florida Statutes. Florida PRIME is under the regulatory oversight of the state of Florida. This investment pool consists of bank instruments, asset-backed securities, and commercial paper. The pool operates as a money market fund but is classified as an external investment pool. The weighted average days to maturity of Florida PRIME was 45 days as of September 30, 2024. On September 30, 2024, the Authority had $39,251,090 invested in Florida PRIME.

As of September 30, 2024, cash equivalents placed in money market accounts with PALM was $98,360,939.

Florida Statutes, Chapter 280, Florida Security for Public Deposit Act (the Act) prescribes that the deposit authority of the Authority's policy conforms to state statute. Deposits whose value exceeds the limits of the Federal Depository Insurance Corporation (FDIC) are entirely insured or collateralized pursuant to the Act. Under the Act, every qualified public depository shall deposit with the Florida Treasury, eligible collateral of the depository to be held subject to his or her order. The Florida Treasurer, by rule, shall establish minimum required collateral pledging levels. The pledging level may range from 25% to 200% of the average monthly balance of public deposits with an approved financial institution. The Public Deposit Security Trust Funds (Florida PRIME and PALM) have a procedure to allocate and recover losses in the event of default or insolvency. The Authority depositories at year-end were designated as qualified public depositories. All bank balances were covered by the FDIC and the banks' participation in the Act.

| On September 30, all cash and cash equivalents were as follows: | |

| Deposits with financial institutions | $ 63,429,705 |

| Deposits with Florida PRIME | 39,251,090 |

| Deposits with PALM | 98,360,939 |

| Total current assets | $ 201,041,734 |

| Reconciliation to the statement of net position: | |

| Cash and cash equivalents, current | $ 184,959,046 |

| Cash and cash equivalents, current - restricted | 2,978,641 |

| Cash and cash equivalents, noncurrent | 13,104,047 |

| Total cash and cash equivalents | $ 201,041,734 |

Credit Risk

The Authority's investment policy addresses credit risk by restricting the types of investments in which it can invest, consistent with limitations defined in Florida Statutes 218.415.

Credit risk is the risk that a security or a portfolio will lose some or all its value due to a real or perceived change in the ability of the issuer to repay its debt. This risk is measured by the assignment of a rating by a nationally recognized statistical rating organization. The Authority's investment policy permits the following investments, which are limited to credit quality ratings from nationally recognized rating agencies as described below:

- Commercial paper of any United States company or foreign company domiciled in the United States that is rated, at the time of purchase, "Prime-1" by Moody's and "A-1" by Standard & Poor's (prime commercial paper), or equivalent, as provided by two nationally recognized rating agencies. If the commercial paper is backed by a letter of credit (LOC), the long-term debt of the LOC provider must be rated "A" or better by at least two nationally recognized rating agencies.

- Local Intergovernmental Pools with the highest fund quality rating of AAAm or equivalent. Florida PRIME and PALM were rated AAAm by Standard & Poor's on September 30, 2024.

- Corporate bonds issued by corporations organized and operating within the United States or by depository institutions licensed by the United States that have a long-term debt rating, at the time of purchase, at a minimum "A" by Moody's and a minimum long-term debt rating of "A" by Standard & Poor's, or equivalent as provided by two nationally recognized rating agencies.

- Supranational in which the U.S. is a shareholder and a voting member. Must have the highest short- or long-term credit rating as provided by a nationally recognized credit agency.

Custodial Credit Risk

For an investment, custodial credit risk is the risk that, in the event of the failure of the counterparty, the Authority will not be able to recover the value of its investments or collateral securities that are in the possession of an outside party. The Authority's investment policy requires securities to be held by a third-party custodian and be properly designated as an asset of the Authority and held in the Authority's name. As of September 30, 2024, the Authority's investment portfolio was held with a third-party custodian and designated as Authority assets and held in the Authority's name, as required by the Authority's investment policy.

Interest Rate Risk

Interest rate risk is the risk that changes in market interest rates will adversely affect the fair value of an investment. The longer the maturity of an investment the greater the sensitivity of its fair value to changes in market interest rates. In accordance with the Authority's investment policy, investments should be invested to match investment maturities with known cash needs and anticipated cash flow requirements. The Authority's investment policy does not limit the maturities of investments to reduce the interest rate risk.

| Investments | Amount | Fair Value Measurements Using | ||

|---|---|---|---|---|

| Quoted Prices in Active Market for Identical Assets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | ||

| Investments by Fair Value Level: | ||||

| U.S. Government Securities | $15,950,884 | $14,649,645 | $1,301,239 | $- |

| Corporate Issues | 10,169,443 | - | 10,169,443 | - |

| Supranationals | 784,925 | - | 784,925 | - |

| Municipal Issues | 102,799 | - | 102,799 | - |

| Total Investments by Fair Value Level | $27,008,051 | $14,649,645 | $12,358,406 | $- |

U.S. Government securities totaling $14.6 million in fiscal year 2024 are classified in Level 1 of the fair value hierarchy and are valued using quoted prices in active markets.

U.S. Government securities totaling $1.3 million, corporate issues totaling $10.2 million, supranationals totaling $785 thousand and municipal issues totaling $103 thousand in fiscal year 2024 are classified in Level 2 of the fair value hierarchy and are valued using matrix pricing techniques maintained by various pricing vendors. Matrix pricing is used to value securities based on the securities' relationship to benchmark quoted prices. The Authority has no investments classified in Level 3.

Concentration of Credit Risk

The Authority's investment policy does not specifically address the concentration of credit risk. However, the policy indicates that investments should be diversified to control the risk of loss resulting from overconcentration of assets.

On September 30, 2024, the Authority had the following investments:

| Investment Type | Amount | Investment Maturities (in years) | Rating | Agency | |||

|---|---|---|---|---|---|---|---|

| Less than 1 | 1-5 | 6-10 | Over 10 | ||||

| Investments | |||||||

| U.S. Government Securities | $15,950,884 | $7,415 | $15,837,215 | $106,254 | $- | AAA | S&P |

| Corporate Issues | 10,169,443 | 179,713 | 9,989,730 | - | - | A-AAA | S&P |

| Supranationals | 784,925 | - | 784,925 | - | - | AA | S&P |

| Municipal Issues | 102,799 | 102,799 | - | - | - | AAA | S&P |

| Total | $27,008,051 | $289,927 | $26,611,870 | $106,254 | $- | ||

The Authority is required to disclose, by amount and issuer, investments in any one issuer that represent 5% or more of total investments. At this time, the Authority's investments do not include any one issuer over 5% of total investments on September 30, 2024.

B. Restricted Cash and Cash Equivalents

Debt service and bond reserves are set aside for payment of revenue bonds and are classified as restricted cash and cash equivalents and restricted investments since their use is limited by applicable bond indentures.

| Debt service reserve | $ 2,978,641 |

| Bond reserve | 13,104,047 |

| Total | $ 16,082,688 |

C. Leases

The Authority has entered into various lessor arrangements with tenants for the use of warehouses, terminals, offices and land at the port. For the purpose of the GASB 87, the lessor leases have been categorized as follows:

GASB 87 - Included Leases

GASB 87 - Excluded - Regulated Leases

GASB 87 - Excluded - Short-Term Leases

1. GASB 87 Leases - Included

The incremental borrowing rates ranging from 3.00% to 3.08% is used to discount the expected lease receipts to present value. As of September 30, 2024, lease receivable is $41.2 million ($3.7 million current assets; $37.5 million non-current assets) relating to fifty-six (56) leases, with interest income of $1.3 million related to the lease payments received and included in fees and charges for services on the statement of revenues, expenses and changes in net position.

As of September 30, 2024, deferred inflows are $38.8 million, and recognized revenues are $4.6 million.

Future payments included in the measurement of the lease receivable, as of September 30, 2024, are as follows:

| Year/Period | Principal | Interest | Total |

|---|---|---|---|

| 2025 | $3,674,714 | $1,118,547 | $4,793,261 |

| 2026 | 3,390,387 | 1,014,780 | 4,405,167 |

| 2027 | 3,094,146 | 918,003 | 4,012,149 |

| 2028 | 2,901,391 | 833,723 | 3,735,114 |

| 2029 | 2,995,161 | 747,796 | 3,742,957 |

| 2030 to 2034 | 9,451,971 | 2,615,136 | 12,067,107 |

| 2035 to 2039 | 2,883,141 | 1,966,999 | 4,850,140 |

| 2040 to 2044 | 1,867,799 | 1,718,380 | 3,586,179 |

| 2045 to 2049 | 1,920,307 | 1,544,048 | 3,464,355 |

| 2050 and Thereafter | 9,035,303 | 9,464,210 | 18,499,513 |

| Total | $41,214,320 | $21,941,622 | $63,155,942 |

C. Leases (Continued)

2. GASB 87 Leases - Excluded - Regulated Leases and Short-Term Leases

In accordance with GASB 87, the Authority does not recognize a lease receivable and a deferred inflow of resources for regulated leases and short-term leases. Regulated leases are certain leases that are subject to external laws, regulations or legal rulings. For the Authority, the Federal Maritime Commission regulates leases between ports and ocean carriers and other users. The Authority includes commercial cargo and cruise agreements as regulated leases. Short-term leases are certain leases that, at the commencement of the lease term, have a maximum possible term under the lease contract of 12 months (or less) including any options to extend. For the regulated agreements for fiscal year 2024, the total amount of inflows of resources was $125,390,090 which includes minimum payments of $38,554,864 and variable payments of $86,835,226.

Future minimum payments for regulated leases and short-term leases are as follows:

| Years Ending September 30: | |

|---|---|

| 2025 | $37,766,519 |

| 2026 | 52,471,958 |

| 2027 | 72,611,397 |

| 2028 | 68,976,795 |

| 2029 | 51,827,640 |

| 2030 to 2034 | 261,180,554 |

| 2035 to 2039 | 268,377,466 |

| 2040 to 2044 | 166,119,796 |

| 2045 to 2049 | 26,043,082 |

| 2050 to 2054 | 16,642,953 |

| 2055 to 2059 | 11,267,930 |

| Total | $1,033,286,090 |

D. Capital Assets

Capital asset activity for the year ended September 30, was as follows:

| Balance October 1, 2023 | Increases | Decreases | Balance September 30, 2024 | |

|---|---|---|---|---|

| Capital assets, not being depreciated/amortized: | ||||

| Land | $ 5,470,630 | $ - | $ - | $ 5,470,630 |

| Construction in progress | 43,190,749 | 115,687,007 | (35,554,118) | 123,323,638 |

| Total capital assets, not being depreciated/amortized | 48,661,379 | 115,687,007 | (35,554,118) | 128,794,268 |

| Capital assets, being depreciated/amortized: | ||||

| Buildings | 281,603,745 | 524,827 | (3,109,564) | 279,019,008 |

| Improvements other than buildings | 764,285,500 | 14,378,036 | (12,773,042) | 765,890,494 |

| Equipment | 124,147,106 | 15,639,154 | (1,363,609) | 138,422,651 |

| Intangible assets | 16,975,651 | 5,012,101 | - | 21,987,752 |

| Total capital assets being depreciated/amortized | 1,187,012,002 | 35,554,118 | (17,246,215) | 1,205,319,905 |

| Less accumulated depreciation/amortization for: | ||||

| Buildings | (99,616,750) | (13,813,081) | 2,461,869 | (110,967,962) |

| Improvements other than buildings | (349,041,148) | (25,354,368) | 12,520,597 | (361,874,919) |

| Equipment | (94,208,132) | (7,419,782) | 1,344,920 | (100,282,994) |

| Intangible assets | (15,975,198) | (1,249,788) | - | (17,224,986) |

| Total accumulated depreciation/amortization | (558,841,228) | (47,837,019) | 16,327,386 | (590,350,861) |

| Total capital assets, being depreciated/amortized, net | 628,170,774 | (12,282,901) | (918,829) | 614,969,044 |

| Capital assets, net | $ 676,832,153 | $ 103,404,106 | $ (36,472,947) | $ 743,763,312 |

Intangible assets include computer software, a trademark, and risk & port master plan.

E. Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses are comprised of the following as of September 30:

| Accounts and contracts payable | $ 22,715,498 |

| Retainage payable | 2,863,260 |

| Accrued payroll and employee benefits | 2,202,568 |

| $ 27,781,326 |

F. Other Liabilities

As required by GASB Statement No. 49, Accounting and Financial Reporting for Pollution Remediation Obligations, the Authority recognizes certain remediation obligations in its financial statements. The Authority's staff, working in conjunction with outside environmental specialists, developed detailed plans and cost estimates for the pollution remediation. The total estimated and recorded liabilities for the remediation on September 30, 2024, are $637,156. Such amounts are recorded as a component of accounts payable as accrued expenses in the statement of net position.

G. Revenue Bonds and Direct Borrowing Bonds

Revenue bonds are bonds that are offered for public sale. Direct borrowing bonds are bonds negotiated between the Authority and a bank. The revenue bonds are secured by and payable from the gross operating revenues of the Authority. The proceeds of these issues were used for capital improvements and refunding certain outstanding issues of the Authority.